Effective borrowing cost calculator

The cost of debt is the effective interest rate that a company is required to pay on its long-term debt obligations while also being the minimum required yield expected by lenders to compensate for the potential loss of capital when lending to a borrower. 15 20 30 year Should I pay discount points for A lower interest rate.

Wa Qet9qtu6bam

Watch Out for Fed Rate Hikes In March 2022 the Federal Reserve started hiking.

. It can help you calculate your monthly payments show college loan options and determine how quickly you can repay the loan. Comparing mortgage terms ie. In essence our Finance Calculator is the foundation for most of our Financial Calculators.

Home loan calculators are great for helping borrowers understand how much it could cost to service a loan over the loan term. Should I rent or buy a home. Full-function mortgage calculator LVR borrowing capacity Property upsizedownsize Principal payback milestone Break fee calculator Fix or float calculator Credit card real cost Real cost of debt Retirement calculator All our calculators.

1 Aggregate limits up to 350000 for MD DMDDDS OD DO DPM PharmD and DVM. Such changes will only apply to applications taken after the effective date of change. The effective annual interest rate is the interest rate that is actually earned or paid on an investment loan or other financial product due to the result of.

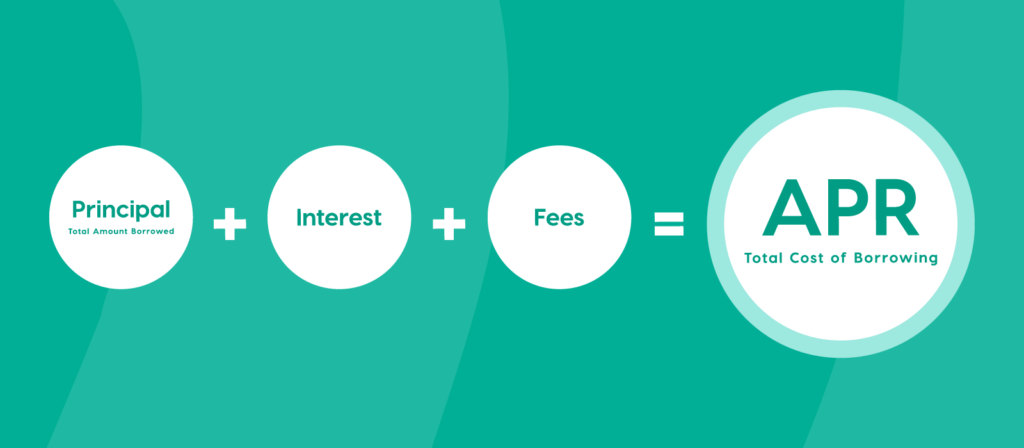

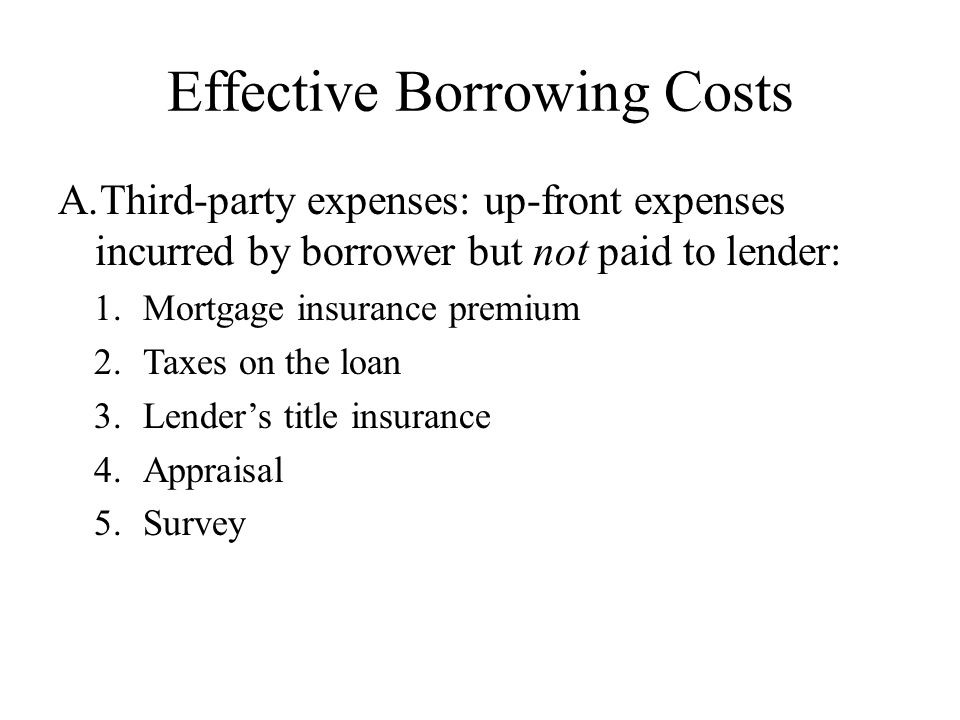

Of these the effective interest rate is perhaps the most useful giving a relatively complete picture of the true cost of borrowing. A mortgages APR reflects the true cost of borrowing for your mortgage. Rather they must consider the effective interest rates.

You can work out what your. 12 Innovative Cost-Saving Ideas to Minimize Expenses Any type of business expense can be a candidate for cost-cutting so there are many ways you can pursue expense optimization. Effective Annual Interest Rate.

Meanwhile this particular loan becomes less favorable if you keep the money for a shorter period of time. Should I convert to a bi-weekly payment schedule. The Importance of the Finance Calculator.

And make sure youre maximizing all other financial aid opportunities first as they might be more cost-effective than parent PLUS loans. Rates on personal loans are at their cheapest for sums of between 7500 and 15000 in some cases stretching to 25000. Note that attendance costs and scholarship availability can vary considerably from school to school.

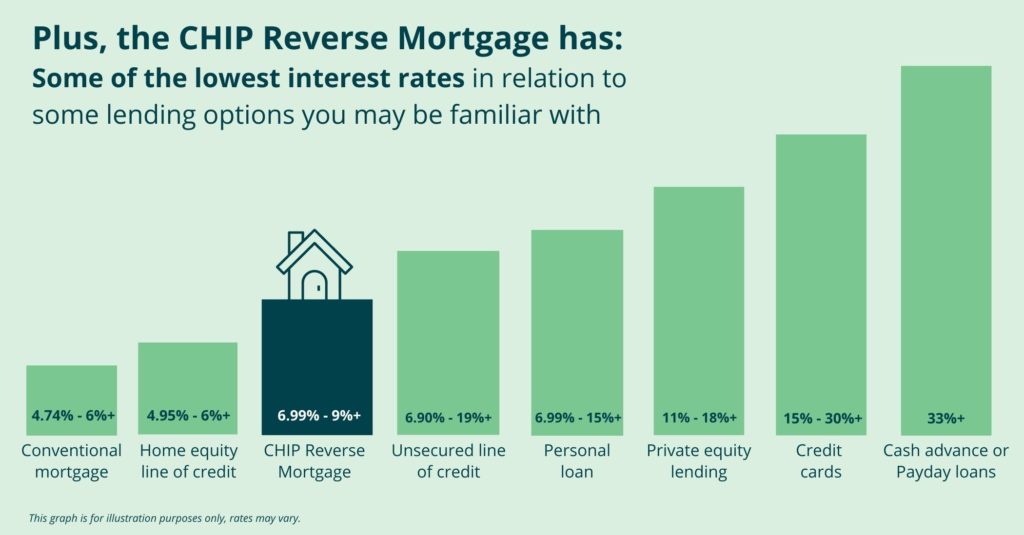

The effective APR adjusts for compounding so that the same car loan might actually have an effective APR of 179 once the snowball effect is considered. So when it comes to borrowing to fund bigger-ticket expenses such as. The amount of money lent on new mortgages fell by a third in June while credit card borrowing jumped by 1billion as households adapted to cost of living increases.

Since interest is deductible for income taxes the cost of debt is typically shown as an after-tax. Real Estate Guides. Example of nominal effective and APR rates.

The cost of debt must reflect the current cost of borrowing which is a. 18 months 519 effective on Monday 8th August 2022. Try our mortgage calculator today and discover your borrowing power.

Mortgage Rates Guides. The third step of calculating the WACC in excel is to find the Companys cost of debt using their borrowing rate and effective tax rate. Popular Course in this category All in One Financial Analyst Bundle- 250 Courses 40 Projects 250 Online Courses 1000 Hours Verifiable Certificates Lifetime Access.

You wanna calculate something. Log in Call Us 0800 500 123. Use this mortgage interest calculator to find out how much interest you are paying.

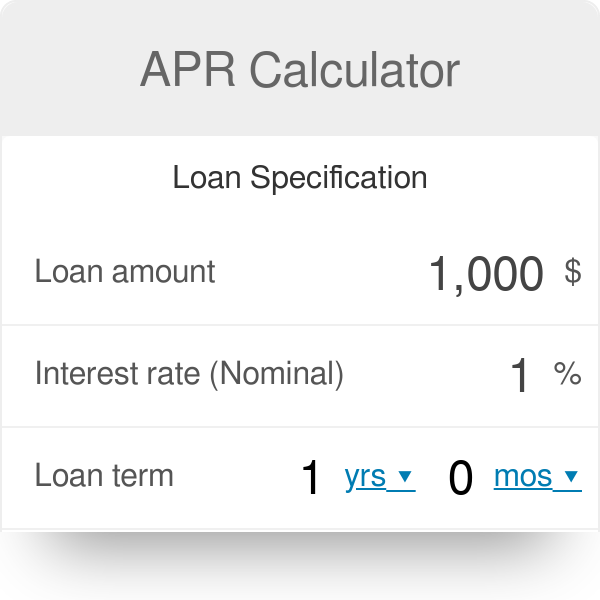

Savings retirement investing mortgage tax credit affordability. Free calculator to find out the real APR of a loan considering all the fees and extra charges. The interest rate is the amount of compensation per period for borrowing money and includes the cost of principal only.

The Truth in Lending Act oversees how US lenders calculate their APR recording fees and charges to ensure a transparent and fair system. It helps to think of it as an equivalent to the steam engine that was eventually used to power a wide variety of things such as the steamboat railway locomotives factories and road vehicles. Check out Citizens student loan calculator.

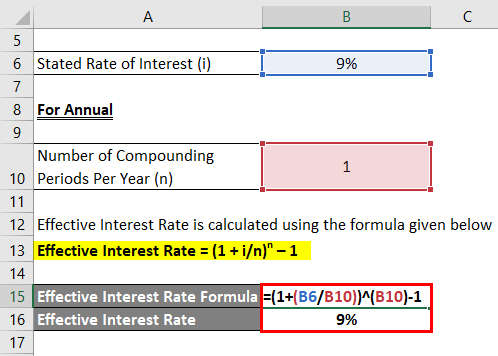

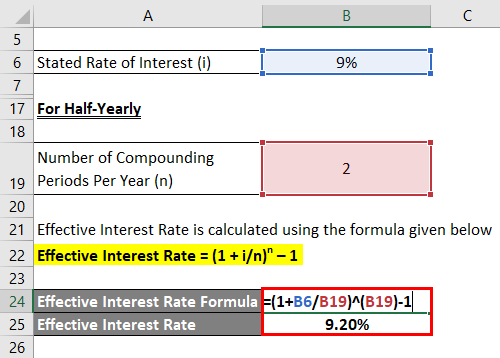

An effective interest rate gives a clear picture of interest compounding multiple periods in a year. The Net Price Calculator will estimate your eligibility for financial aid and show how your cost of attending an affordable college may be reduced with scholarships grants and student loans for first-time students who are US citizens. Compare a no-cost versus traditional mortgage.

Fixed or adjustable-rate. The Worlds Simplest College Cost Calculator allows you to estimate costs based on school types ie. Your net price is the difference between the cost of attendance tuition room board etc and your.

The effective rate on. If your mortgage lender quotes a mortgage rate of 3 then your effective annual rate. Compare two loans to see which is the most effective for you.

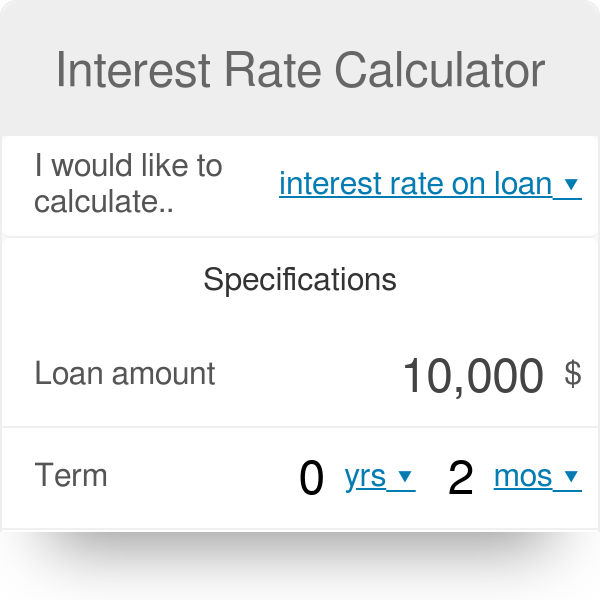

So in spite of having higher assets the business would require borrowing from banks and other financial institutions and hence it will create higher interest costs. To calculate the effective interest rate on a loan you will need to understand the loans stated terms and perform a simple calculation. Commercial banks raised their rates to 825 increasing the cost of borrowing on credit cards and lines of credit.

You can help out with repayment on these loans and they have much lower costs than parent PLUS loans. APY can sometimes be called EAPR meaning effective annual percentage rate or EAR referring to the effective annual rate. This calculator is designed to help you create the most effective funding strategy to cover your expected college costs using a 529 plan.

Also when assessing the cost of borrowing a borrower must not consider the nominal rate levied by the lender. What are the tax savings generated by my mortgage. Combining efficient cost-cutting strategies with effective marketing and sales strategies provides a path to maximize your profits.

For instance discuss having your child borrow the maximum amount of unsubsidized loans first. If a person owes 20000 at 20 pa he will pay Rs4000 as interest. For example if you borrow 1000 from a bank for 120 days and the interest rate remains at 6 the effective annual interest rate is much higher.

Lender S Yield Borrower S Effective Borrowing Costs Apr Youtube

Wa Qet9qtu6bam

Effective Interest Rate Formula Calculator With Excel Template

Pin On Building Credit

Learn The True Cost Of Borrowing Birchwood Credit

Top 10 Tips For Buying An Investment Property Buying Investment Property Investment Property Investing

Cost Of Debt Kd Formula And Calculator Excel Template

How To Calculate Effective Interest Rate 8 Steps With Pictures

Coming Soon Png Transparent Images Just Listed Banner Png Image With Transparent Background Png Free Png Images Transparent Background Earth For Kids Transparent

Chapter 15 Mortgage Calculations And Decisions Ppt Video Online Download

Effective Interest Rate Formula Calculator With Excel Template

Interest Rate Calculator Effective Interest Rate

Chapter 15 Mortgage Calculations And Decisions Ppt Video Online Download

Here S An Overview Of The Education Loan Process Education Free Education Loan

Effective Interest Rate Formula Calculator With Excel Template

Apr Calculator Annual Percentage Rate

Chip Reverse Mortgage Rates Homeequity Bank